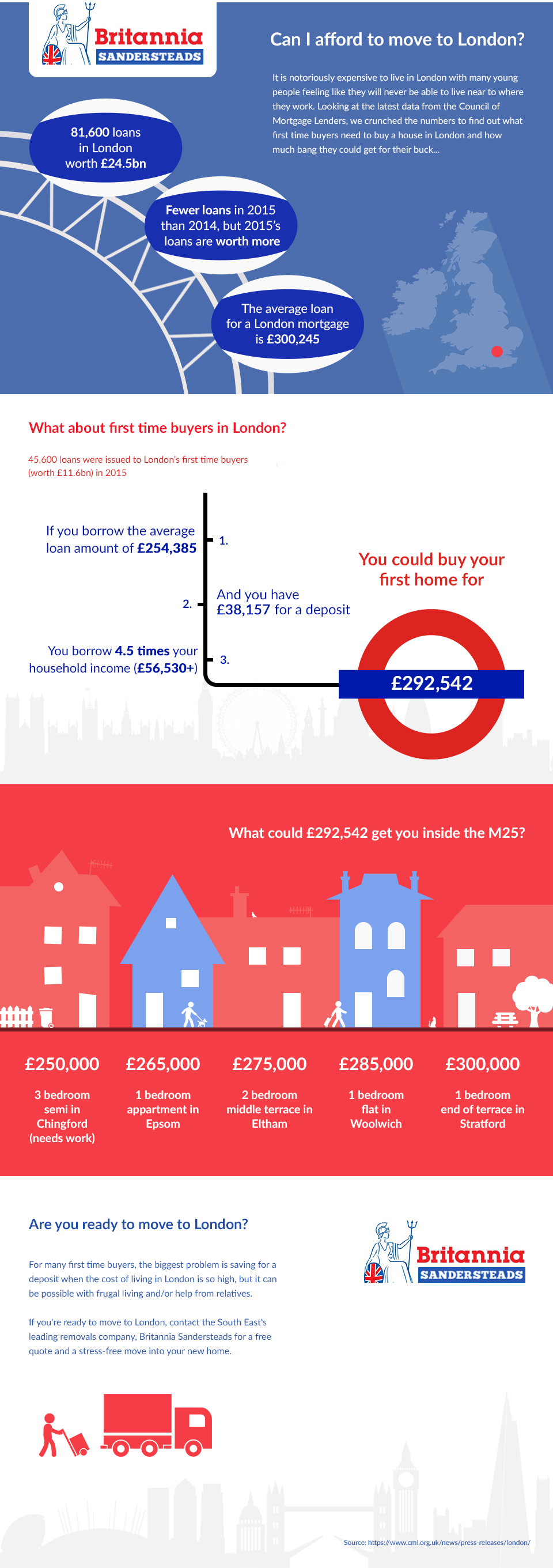

Can you afford to buy a home in London? [Infographic]

The idea of buying a home in London might seem impossible to young people with the cost of living in the capital rising ever higher but the latest data from the Council of Mortgage Lenders shows that 45,600 loans were issued to first time buyers in London in 2015, indicating that first time buyers are not entirely locked out of the property market.

Whilst the same amount of money might enable mortgage-seekers to buy a more spacious home in other towns and cities across the UK, it seems as though first time buyers are in fact finding it possible to purchase property inside the M25.

We looked at the latest data (released Feb 2016) to work out if people earning the average UK salary can afford to buy a home in London and what they might be able to get for their money.

If you think you might be ready to move to London, contact the South East’s leading house removals, company Britannia Sandersteads.

Share this Image On Your Site